How the Cloud-Native Enterprise Compute War Was Won in 2025

And how the "war" fizzled

On STH, we have been reviewing Arm-based servers since 2016. It took until the Ampere Altra/ Altra Max to make a splash as a cloud-native processor, and those chips got Intel and AMD to react. Perhaps the strangest aspect of this market is that even with Intel, AMD, and Arm vendors like Ampere launching their own cloud-native offerings to serve a specific market, in the enterprise space, it feels like 2025 has already been won by x86’s 2024 cloud-native processors.

Cloud-Native Compute

The idea behind cloud-native processors was simple. Over time, large application domains developed that did not use a lot of the higher-end features in modern CPU cores. My favorite way of discussing this is simply in the context of web servers where the vast majority of websites, virtually all outside of the top 20,000 or 50,000 in terms of traffic, could use a single, entry-level server processor to host them, with room to spare. Big cores with massive vector pipelines were being wasted in these workloads of integer computing and low utilization.

When we say “cloud-native,” there is another reason I tend to use web servers as a prime example. Enterprises deploy a large number of websites, both internal and external. At the same time, those are often the same organizations running Microsoft Windows Server and VMware products, among others, that are licensed per core or in packs of cores. The industry's guidelines regarding software licensing have been to use fewer and faster cores to optimize license costs. Applications like nginx web servers and others were optimized for a more open-source stack rather than a world of per-core licensing.

In the hyper-scale data centers, Arm is doing well. Hyper-scalers have their own Arm server CPU designs, and we continue to hear more of them. AMD has also found quite a bit of success selling its high-core count parts that a hyper-scaler can drive scaling gains from simply having bigger chips. We discussed last time how we are planning for AMD to exit 2025 with 40% share. The hyper-scale/ cloud markets have been big consumers of AMD’s higher core count parts. Intel for its part, insists that it has customers for the Sierra Forest platforms, something we hope to hear more about, but we know there is at least one very large customer.

The theory had been that once hyper-scalers were comfortable with cloud-native parts, that would trickle down to fierce competition in the enterprise space. That has largely fizzled out.

What Made 2025 “The Year” and Then Not

In 2023-2024, the competition felt fierce. On the Arm side the AmpereOne platforms with 192 cores (192 threads) were exciting. While the initial launch was for an 8-channel DDR5 platform, we knew a 256-core 12-channel DDR5 platform was coming. HPE launched the ProLiant RL300 Gen11 with the previous generation Altra Max processors. Supermicro had edge GPU platforms based on Altra Max and AmpereOne. Things were looking up for Ampere and Arm servers in the enterprise.

AMD started transitioning its “c” core architectures from Zen 4c with Bergamo to Zen 5c with Turin Dense. AMD was able to match Ampere’s 192 cores but with 384 threads. It was also AMD’s second-generation product, proving a commitment to the market. Something that AMD did not really advertise, but the Arm folks used to tout as a benefit to their parts was the consistent performance by not letting a few cores race to higher frequencies. When we first saw Bergamo hit a frequency cap across all cores, we realized that AMD intended to make that point moot.

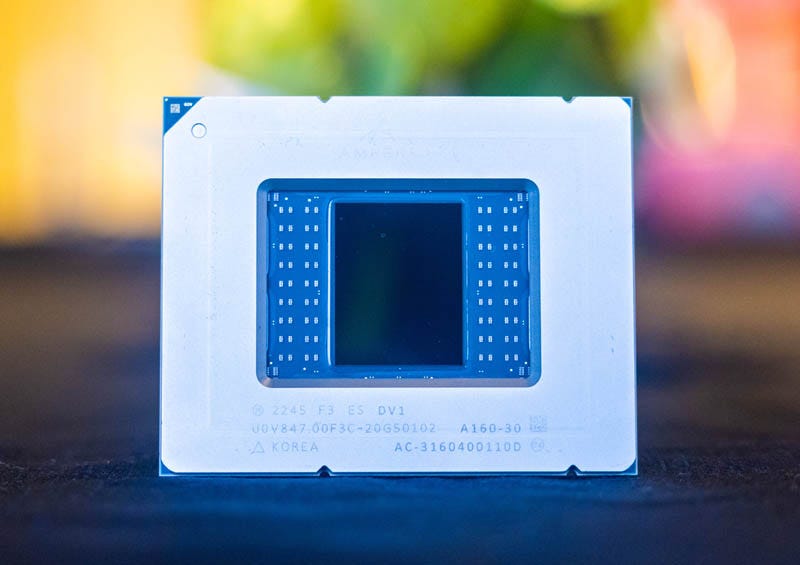

Intel had a more radical approach than AMD. It designed efficient, or “E-cores,” that removed features to save on die area. Hyper-threading was also removed in the quest to fit as many cores onto a chip as possible. With its Xeon 6700E “Sierra Forest-SP” launch in 2024, it was months ahead of AMD’s Turin Dense and provided a compelling alternative to AmpereOne’s lower core count SKUs. Sierra Forest-SP at 144 cores would be followed by a 288 cores Xeon 6900E “Sierra Forest-AP” launch. The fast-follow was to be a showcase of Intel Foundry’s 18A and Intel’s packaging prowess with Clearwater Forest in 2025.

Fast update cadence, multiple vendors competing in the market, and a clear value proposition behind making the switch seemed to prime 2025 for being an exciting year in enterprise cloud-native compute. Then, the world changed.

2025’s Enterprise Cloud Native Shake-Out

Let us quickly go through the three big vendors making a splash in enterprise cloud-native processors in 2025. We are excluding NVIDIA Grace here, as that is focused on AI compute and not cloud-native web servers, indeed even lacking some essential features for that market. Others could try to enter the market, but as we are already almost two months in, an enterprise ramp schedule would make anything not announced at this point harder to do enough volume to win in 2025.