Last week, HPE had a rough earnings announcement. The company is struggling with being behind in AI, even with a dominant position in HPC. The earnings announcement on March 7, 2025 was another big drop with the company shedding over a quarter of its stock price in the last month. We went back through our STH page view data and found a really interesting trend.

Reading the STH Page View Data

For some context, at STH, we have a lot of content going back over 15 years at this point. It may seem strange, but even old content still gets some traffic. A prime example of this that I use is Cavium, maker of perhaps the first commercial and viable Arm server chips that made it to market. Marvell’s acquisition of Cavium closed in July 2018. That was just after our Cavium ThunderX2 review went live. That was the last review we track as part of our Cavium coverage. Even seven years later, we get roughly 20 people per day looking at those old Cavium ThunderX (1) and ThunderX2 pieces. The tail is strong.

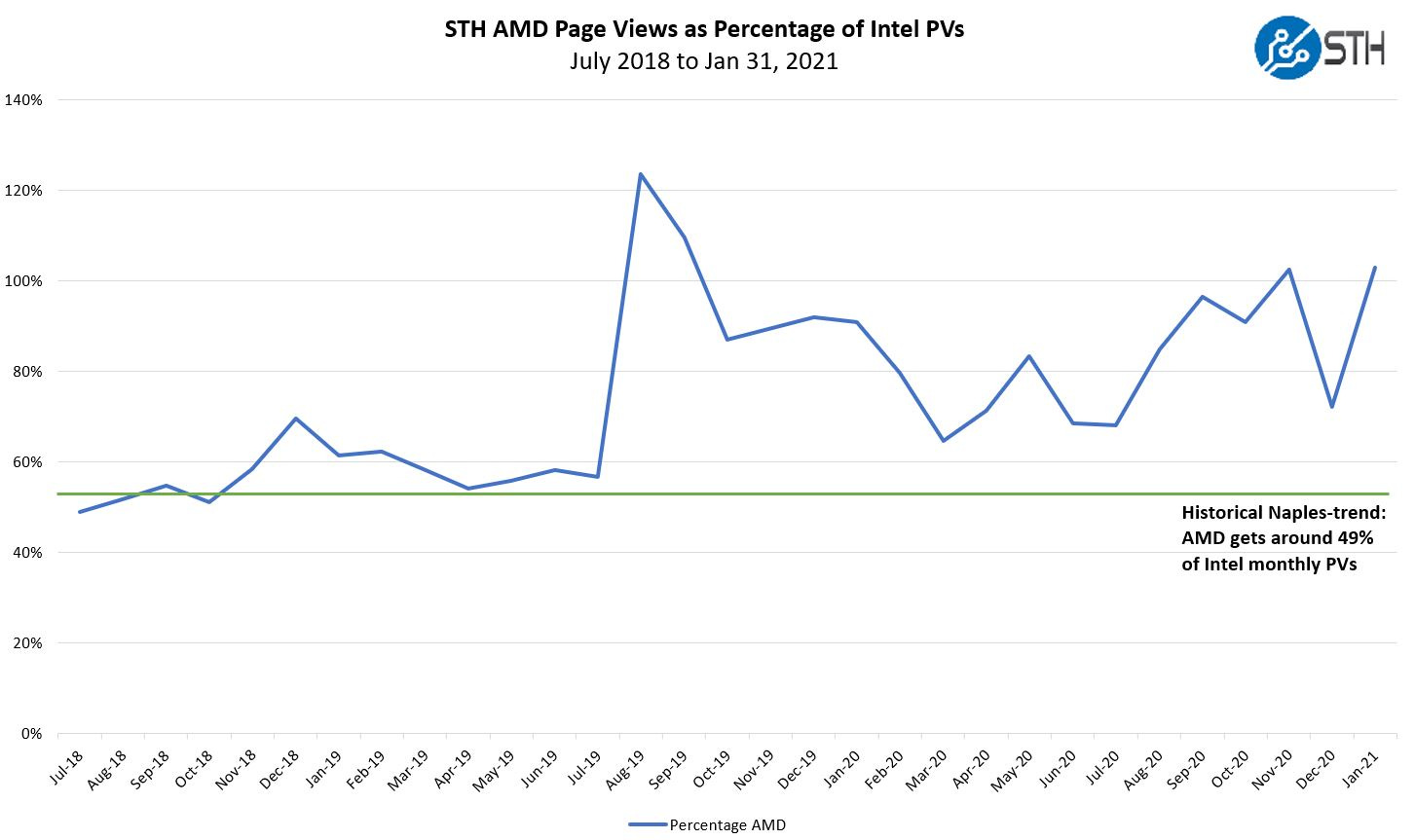

For major server OEMs, chipmakers, and so forth, we track the simple data behind things like page views just to see how the market is reacting. At the 2019 AMD EPYC “Rome” launch, we saw the first inversion of AMD getting more page views than Intel on STH, indicating that the market was taking notice.

That August 2019 blip was the AMD EPYC 7002 “Rome” launch. When we talk about products that make a major competitive impact, this is one of my favorite charts to use. It was also at a time where there was a lot less coverage of AMD platforms before Rome so getting a baseline was harder.

Another fun fact: most months, we get more NVIDIA page views than the extremely popular NVIDIA Blog, despite NVIDIA being an extremely hot topic right now and NVIDIA putting out more pieces of content monthly than we do on NVIDIA. One advantage we have is simply having a lot of content and a lot of views on each piece of content since we only aim to publish once daily.

Often, as companies gain or lose mindshare, we can see it in our data as one to augment Google Trends. In this case, that happened to HPE over the last two quarters on STH. Let us take a quick look at the data.

HPE Page View Comparison

At STH, we have seasonal page view trends, and there are even smaller impacts, like the number of weekend days per month and quarter, that can impact our page view trends. Instead, we tend to benchmark page views versus competitors in the same period. To do that, we have some baseline content that we track for each vendor because simply having more articles focused on a company means we often end up getting more page views. It is not too useful to know we got more page views in a month with more non-holiday weekdays and where we published five times more content than the prior month. We need a baseline set of content to track, and that is easier when we have a long history of covering companies and lots of content that has fallen out of news cycles. For HPE, this is what the quarterly roll-up looks like. Please note HPE’s fiscal year is offset from the calendar year.